We’re excited to present the third edition of our Year in Music report, diving into the sounds, stats, and standout trends of 2025. This year’s report expands on 2024's insights, providing a comprehensive view into key areas of the music industry — from artist development to emerging fandom dynamics and streaming trends. With data from millions of tracks and artist profiles collected since 2016, join us as we explore the defining moments of 2025 in music.

Here's a sneak peek of some of the main takeaways:

2025 Signaled a Shift in the Hit Lifecycle

Only three of Spotify’s top 10 most-streamed songs were released in the same year—a reversal from 2024, when just three top tracks carried over from 2023. This follows after Chartmetric identified a slowdown in breakout hits earlier last year, with only 23 songs reaching the top charts in Q1 and Q2 of 2025, compared to 49 during the same period in 2024.

At the same time, three times as many artists reached Chartmetric’s “Superstar” status in 2025, suggesting that while artists may be breaking through faster than before, sustaining long-term chart dominance is becoming increasingly difficult. In a market constantly chasing the next breakout moment, success is harder to hold—and longevity is no longer guaranteed.

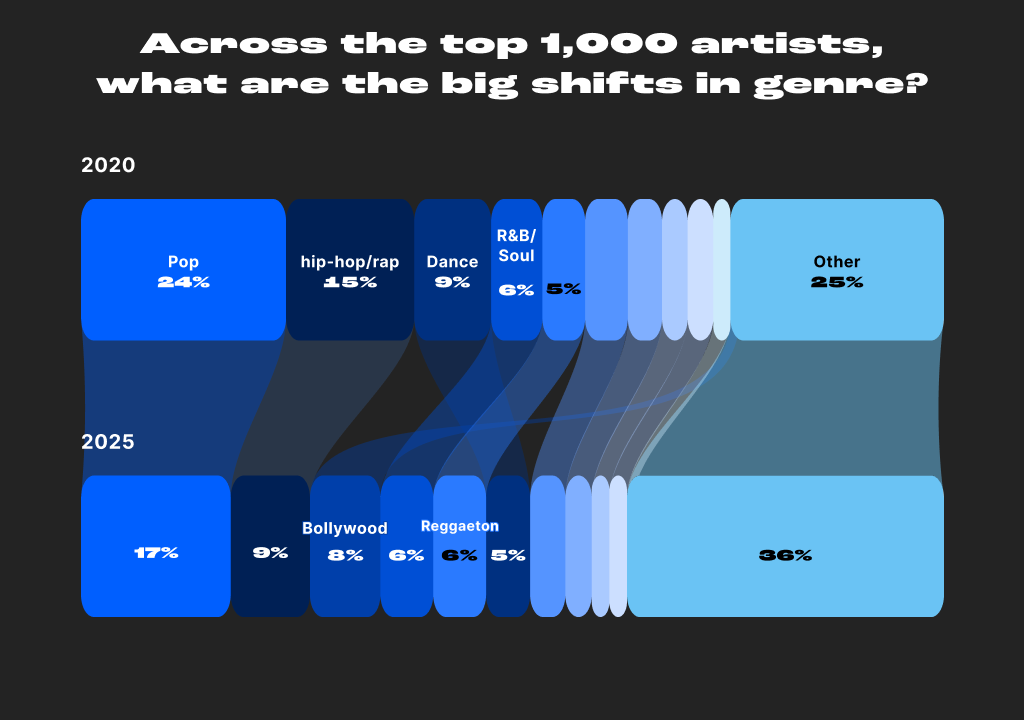

Regional Genres Are Driving Global Growth

Chartmetric data shows a clear shift away from traditional genres among the top 1,000 artists, with 'other' genres such as Bollywood, K-pop, Brazilian funk, and Reggaeton emerging as the fastest-growing sounds within this category since 2020. This rise in regional sounds is mirrored geographically, as markets outside the traditional Anglophone strongholds continue to gain influence. South Korea now accounts for five times as many artists in the top 1,000 compared to 2020, India’s share has surged from 0.6% to 11%, and Puerto Rico has maintained a strong 5% presence—an outsized contribution given its small population. Together, these trends highlight the continued globalization of success and the growing impact of regional markets on the global music ecosystem.

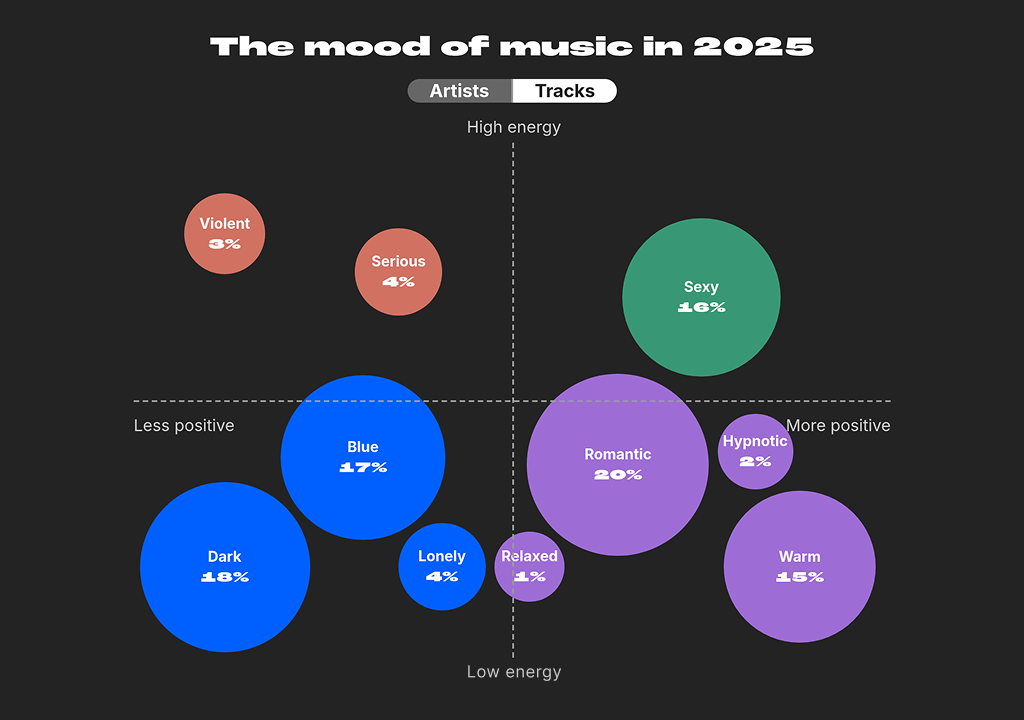

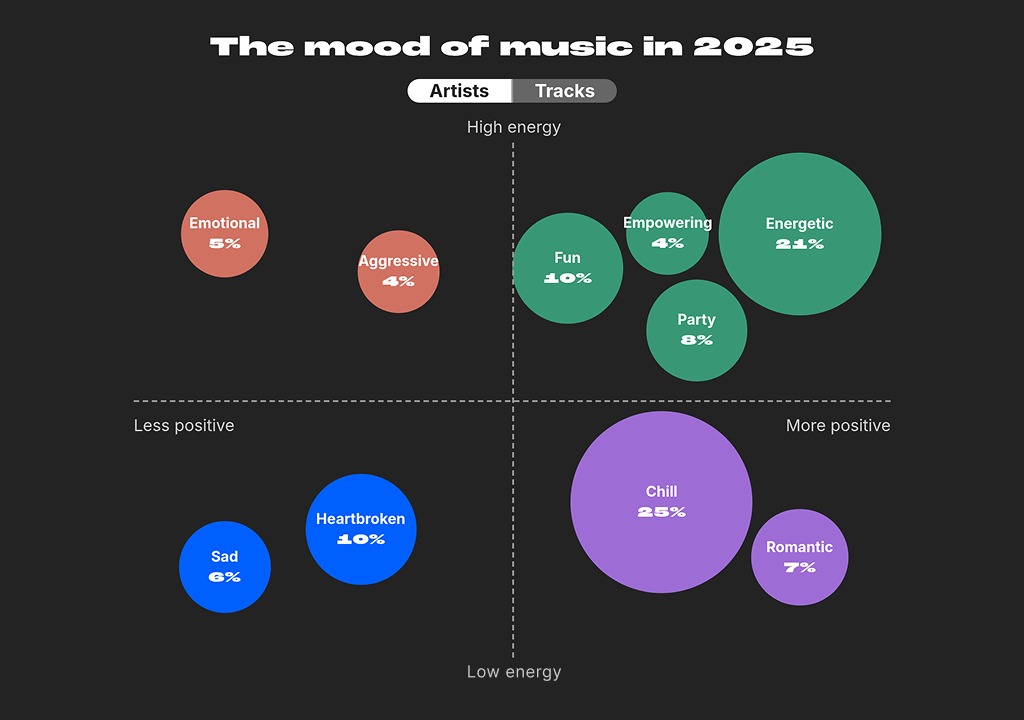

The Music of 2025 Was Moody

In 2025, “chill” remained the dominant mood associated with artists. At the track level, however, listener engagement leaned more emotional, with romantic songs leading at 20%, followed by darker and more introspective moods—“dark” (18%) and “blue” (17%). This contrast suggests that while artists may be branded around relaxed, accessible identities, individual tracks are where deeper emotional storytelling and experimentation resonates most.

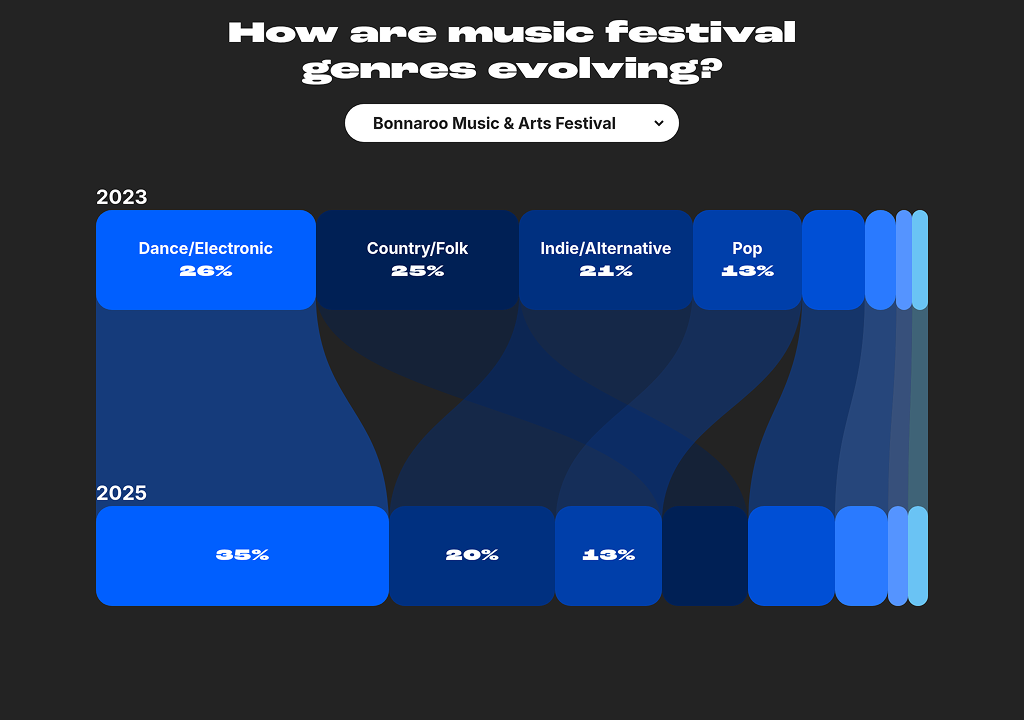

Genres Are Shifting Across Major Music Festivals

Festival lineups are evolving beyond genre-specific roots to better reflect shifting fan tastes. From 2023 to 2025, dance/electronic emerged as the fastest-growing category across several major U.S. festivals, rising 9% at Bonnaroo, 12% at Lollapalooza, and holding steady at nearly 50% of Coachella’s lineup.

Meanwhile, representation across hip-Hop/rap, rock, and pop shifted unevenly, reflecting how festivals utilize fine-tuned booking strategies to align more closely with audiences.

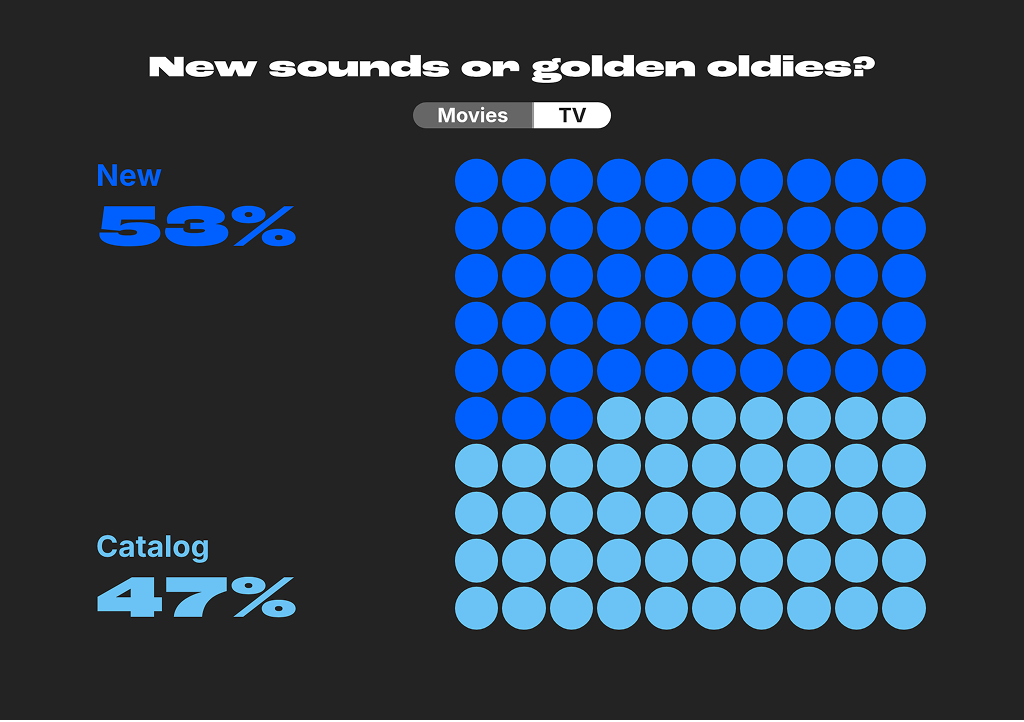

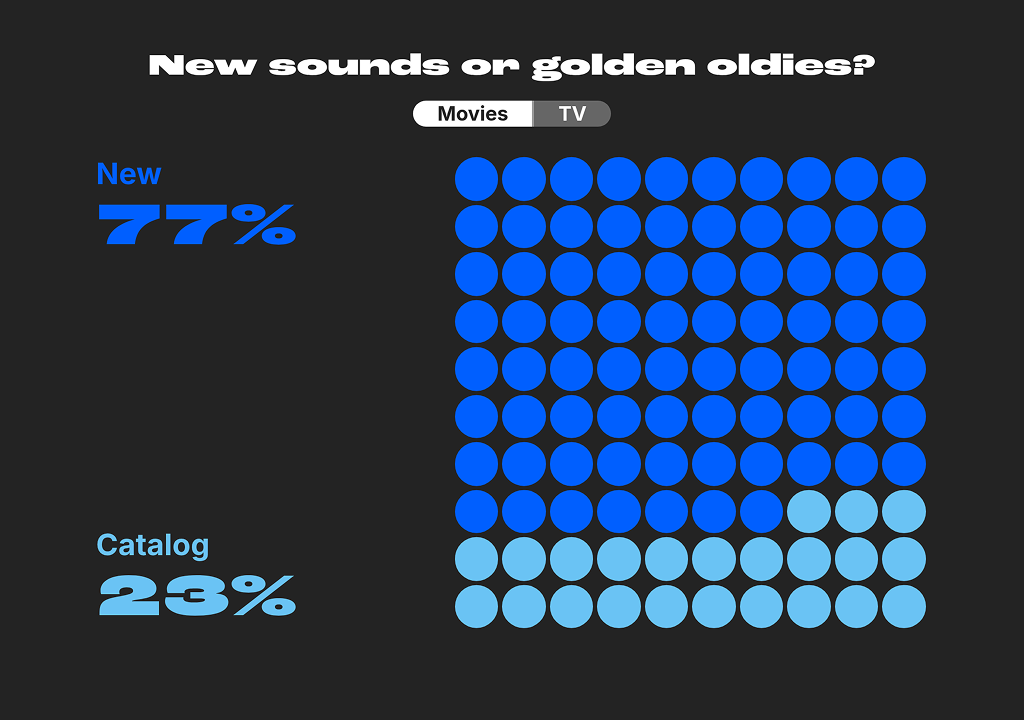

Sync Was a Driving Force For Classic and New Hits in 2025

Sync continued to play a significant role in shaping the biggest hits of 2025, with new soundtracks—such as K-Pop Demon Hunters—driving some of the year’s most-streamed tracks. At the same time, established catalog songs saw renewed momentum through high-profile placements in TV series like Stranger Things. Notably, television leaned heavily toward catalog music, with 53% of TV syncs in 2025 featuring older tracks, while films favored newer releases, with only 20% of movie syncs coming from catalog.

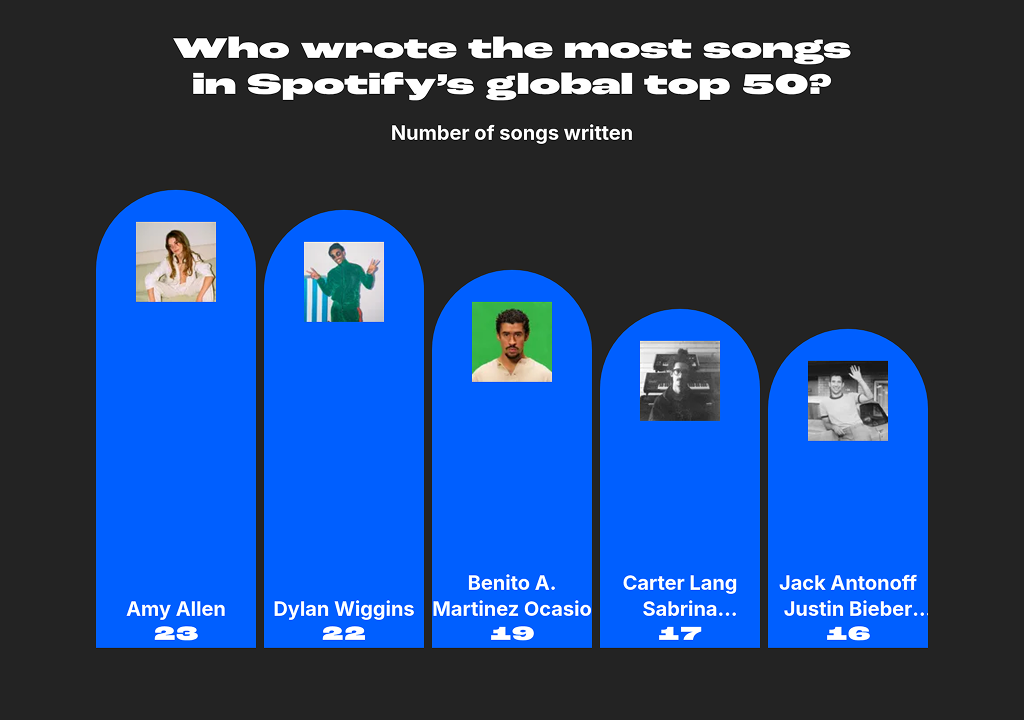

Songwriting is Both Collaborative and Independent

While the use of large songwriting teams has become increasingly common, particularly at the highest levels of success, artists remain deeply involved in the creation of their own music. In fact, half of the top 10 songwriters by number of charting songs in 2025 were the artists themselves, including Bad Bunny, Justin Bieber, Lady Gaga, Sabrina Carpenter, and The Weeknd.

At the same time, collaboration remains central to today’s hit-making process, with more than half of 2025’s charting tracks featuring multiple collaborators.

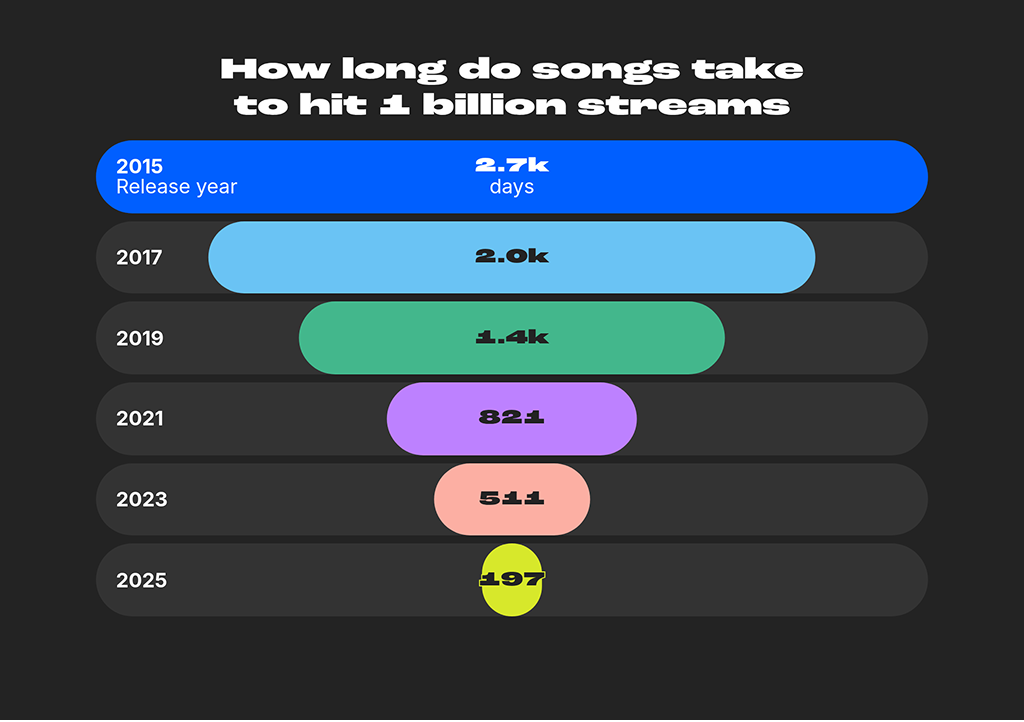

Streaming Milestones Are Increasing Exponentially

A decade ago, reaching one billion streams was a rare milestone reserved for only a handful of tracks. By 2025, that threshold is growing at an exponential rate, with the average time to hit billion streams falling from 2,729 days in 2015 to just 197 days. This acceleration reflects the combined impact of how streaming adoption, globalized fanbases, and algorithmic discovery are reshaping the rate at which hits emerge. Read more on our 2025 billions club analysis here.

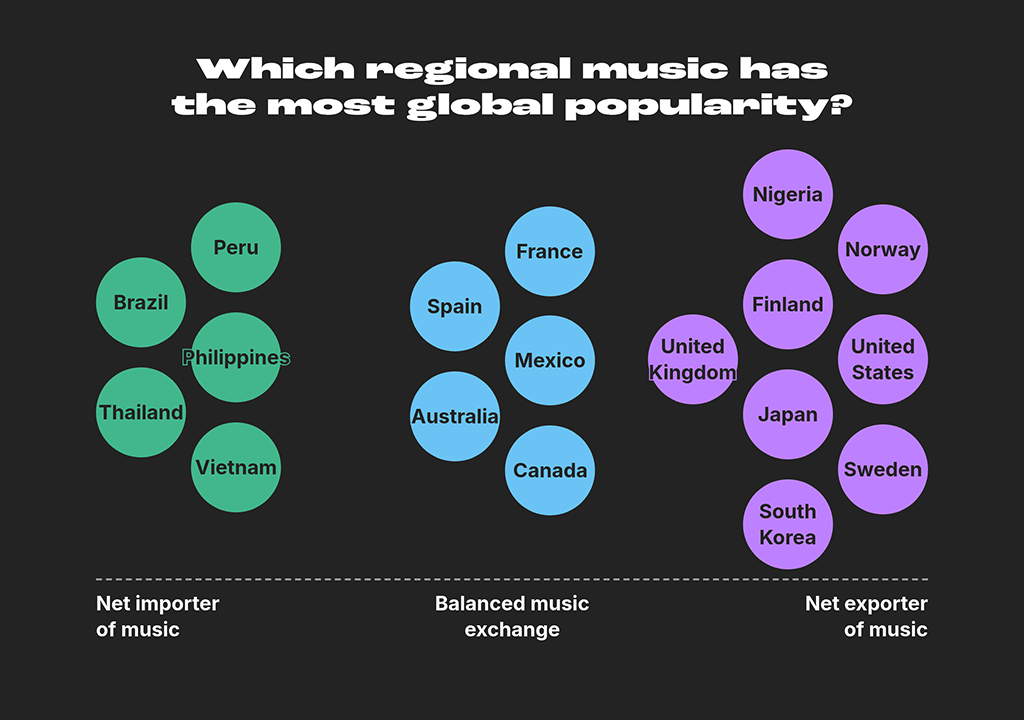

Exporters, Importers, and the Players Behind Global Music

In 2025, South Korea and Norway emerged as leading global exporters of music, while trigger city hubs across Southeast Asia and Latin America stood out as major importers of international hits. This dynamic underscores the growing influence of regional listening hubs in amplifying global repertoire.

As for the power players in these markets, major labels continued to dominate in most countries. Still, independent labels remained highly competitive—particularly in countries with strong cultural identities—by leveraging deep connections to local scenes and audiences.