Tamur Yusifzai is Chartmetric's Product Manager, and he loves the space where tech and music collide.

K-Pop Across the Globe

For more than 15 years, K-Pop grew from a regional sensation to a cultural powerhouse that is now found everywhere from viral tracks on the Billboard Hot 100 charts to U.S. malls distributing the latest merchandise. With BTS and BLACKPINK being the latest artists to capture our attention, the catchy, polished music with picture-perfect idols regularly sells out arenas worldwide. The enigmatic business continues to inspire the rest of the global music industry with its legendary fandoms ... and there's always more to discover.

Our goal with this analysis was to dive deeper into this phenomenon in order to answer two main questions. The first was to use our data to uncover where K-Pop has made its mark globally and where its biggest audience lies. The second goal was to examine the trends in K-Pop's expansion to explain what drives its appeal across a vast number of countries, languages, and cultures.

To do this, we looked at the Top 200 K-Pop artists in terms of Spotify Monthly Listeners, although we excluded BTS and Blackpink from our analysis due to their outlier status as global megastars. You can find a list of these artists and their global reach below:

We then analyzed global consumption and engagement patterns across three main channels: Spotify (Monthly Listeners), Instagram (Followers) and YouTube (Views). Next, we dug deeper into the two main regions of interest — Asia and the Americas — and examined trends seen across countries. Finally, we dove deeper to look at top regional cities for K-pop and their performance historically to determine the trajectory of this trend.

Regional Analysis

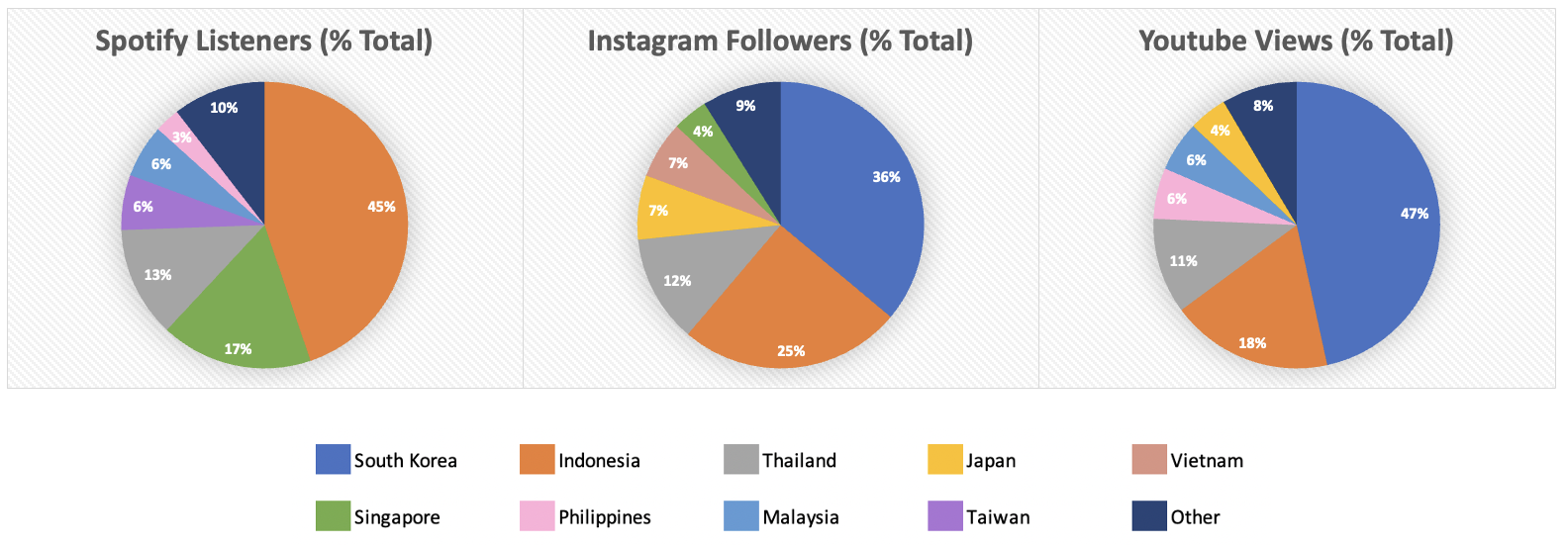

Looking at the Top 200 K-Pop acts across the globe, we see several trends arise. First, the greatest percentage of consumption/engagement can be found in East and Southeast Asia. This is consistent across both Instagram Followers and YouTube Views. The large discrepancy in Spotify Monthly Listeners across these two regions is due to its muted presence in East Asia. For instance, Spotify did not launch in Korea until February 2021, is unavailable in China, and competes with local streaming services in Japan.

When we expand our scope to the global level, we see that while K-Pop has not enjoyed the success witnessed in Asia, it has established a toehold in North and South America. This trend is consistent across all three platforms that we looked at, with consumption and engagement hovering in the single digits. As we will explore in depth throughout this post, much of the global success of K-Pop stems from how it appeals to a broad array of listeners via catchy music, wholesome themes, attractive idols, and exciting dance routines, thus allowing it to easily translate across cultures.

These trends are unsurprising for several reasons. While Korea is the epicenter of K-pop, the genre has long been understood to be one of Korea’s most successful exports. Over the last decade, the value of music industry exports from South Korea has grown at a Compound Annual Growth Rate (CAGR) of 38 percent and is projected to crack $1B in 2020. Given this, South Korea’s largest trade partners serve as a good proxy for the success of K-Pop, with China (26 percent of total exports), the United States (15 percent) Vietnam (10 percent), Hong Kong (6 percent), Japan (4 percent), and Taiwan (3 percent) proving to be some of the genre’s biggest consumers.

Asia: K-Pop Consumption and Engagement

When digging into which Asian countries are the biggest consumers of K-Pop across Spotify, Instagram, and YouTube, we see that South Korea unsurprisingly comprises the lion’s share of the genre's fanbase. However, K-Pop also has left a significant imprint on Southeast Asia, with this region covering at least a third of consumption across those three platforms. Specifically, Indonesia and Thailand are consistently the largest regional importers of the genre, with other countries such as the Malaysia, Singapore, and Vietnam making up a meaningful portion of consumption.

Other East Asian countries have a somewhat misleading representation within this data. Japan, the second largest music market after the United States, has a massive K-Pop following. However, the digital streaming and social media marketplace is saturated with local competitors such as Line Music, resulting in deceptively low consumption across US services like Spotify and YouTube. Similarly, despite being a huge market for K-Pop, China is not represented at all due to the stringency of its censorship laws.

K-Pop's wide appeal across Asia is due to several factors. The geographic proximity allows for easy dissemination of music, encourages cross-pollination of digital streaming services and facilitates live shows. Content wise, K-Pop boasts a wide appeal, featuring innocuous and positive lyrics that appeal to the family oriented cultural sensibilities of the region. K-Pop's youthful effervescence and dreamy idols mean the genre is especially impactful in nations with a high proportion of young people, such as Indonesia (28 percent of total) and Vietnam (27 percent).

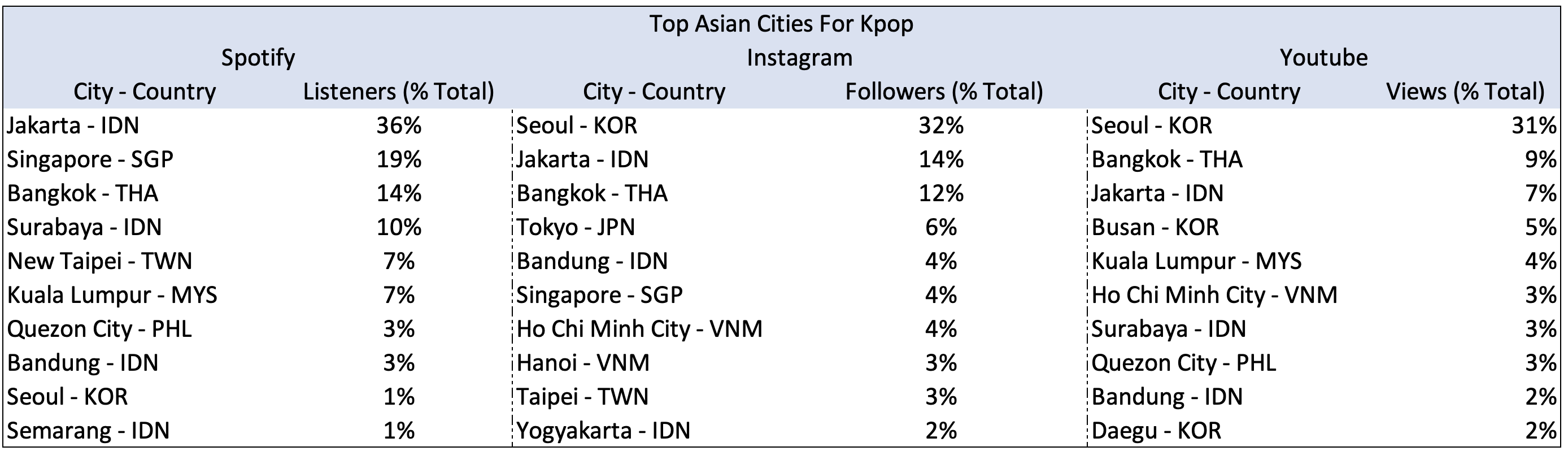

Top Asian Cities for K-Pop

When zeroing in on the Top 10 Asian cities for K-Pop we see similar trends, with Seoul comprising the majority of both Instagram Followers and YouTube Views, although having launched Spotify in early 2021, it currently comprises only a trickle of listeners. Bangkok and Jakarta are consistently in the Top 3 cities, comprising between 16 and 50 percent of the total consumption and/or engagement across all three platforms. In terms of frequency, Indonesian cities are represented the most in this Top 10 list, while other countries boast only a few cities.

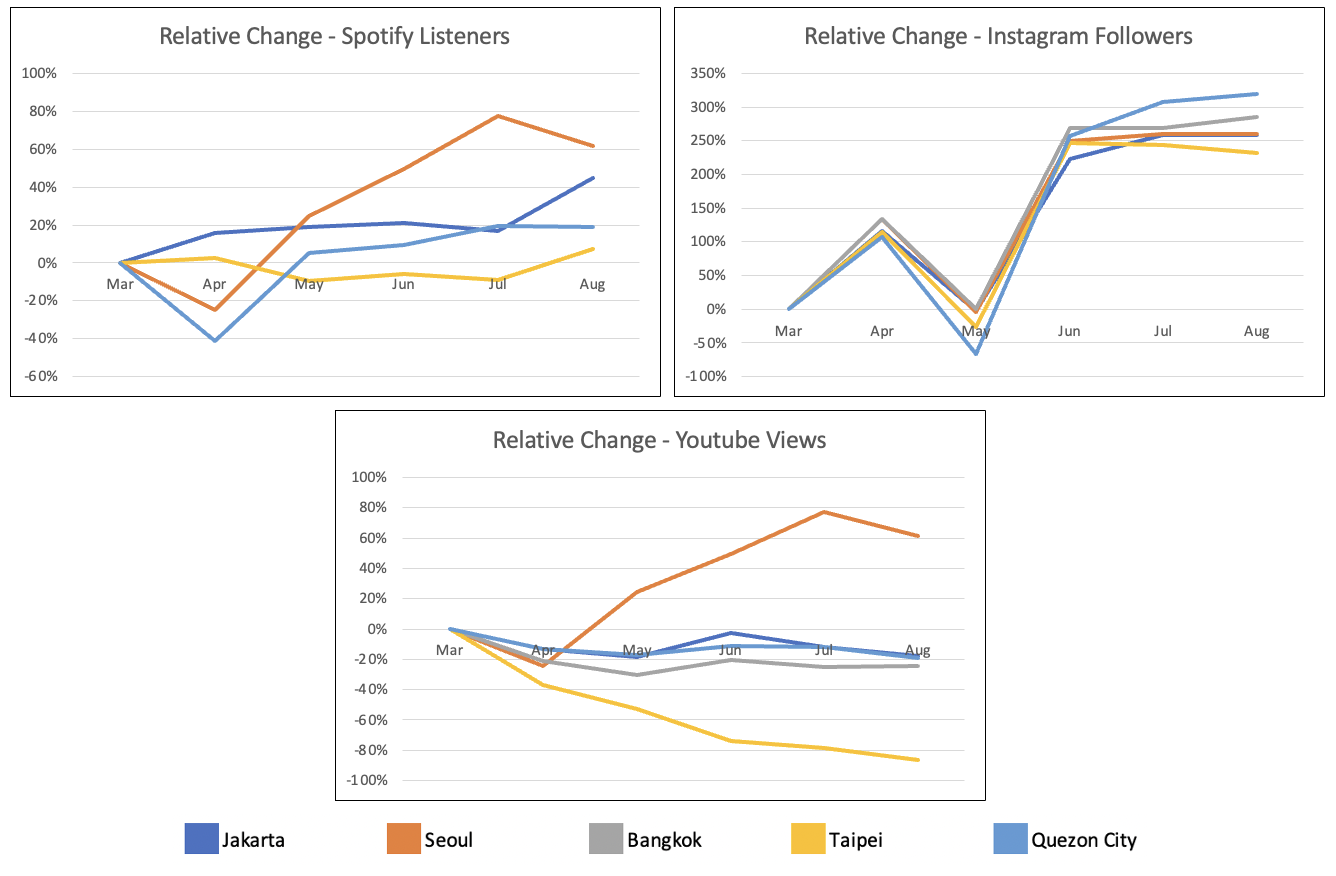

Historical Change Across Cities

Digging into historical performance in some of these key cities, we see that (unsurprisingly) Seoul remains a consistently strong consumer of K-Pop across Instagram, Spotify, and YouTube when looking at the last five months. Most cities displayed varied results across Spotify and YouTube due to a variety of streaming opportunities in the region. However, given Instagram’s ubiquity as a social media platform, we see a fairly tight progression across all cities, with each posting between 200 and 350 percent growth since March. Jakarta, Bangkok, and Quezon city posted performance in lock with one another, while Taipei proved to be the weakest performer.

The Western Hemisphere: K-Pop Consumption and Engagement

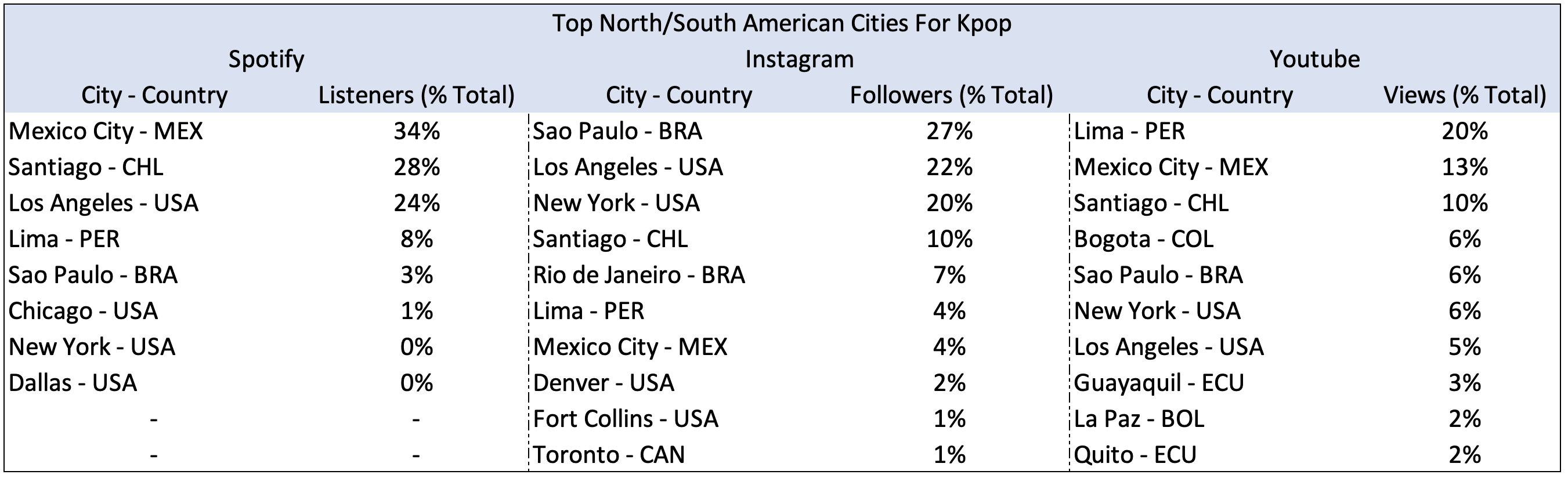

When we turn our attention to both North and South America, we see K-Pop gaining a toehold within the region. Looking across countries we see that in terms of Spotify and YouTube, Mexico acts as a Trigger City with the highest number of listens and/or views. This is then followed by either the United States, Peru, or Chile, with the order depending on the medium of distribution. Instagram shows the largest deviation from these trends, with Mexico, Chile, and the United States comprising nearly 90 percent of K-Pop followers.

The K-Pop wave has been well documented in the United States. Although K-Pop acts started testing the waters around the turn of the century, it wasn’t until the 2010s that the genre truly took off in the US thanks to breakthrough artists such as PSY and Wondergirls. This trend continued through the second half of the decade as mega-groups such as BTS and Blackpink shattered expectations for the genre’s success in America. K-Pop artists are now cracking the Billboard 100, collaborating with US superstars, and selling out stadiums.

After a 2016 crackdown on K-Pop by China in response to Korea’s deployment of a US missile system, K-Pop companies began pushing their artists to explore new marketplaces. While previous responses to K-Pop idols were mixed, several underlying factors made for a more receptive audience during this time period. First was the young, diverse, and digitally native Generation Z coming of age. Already well associated with other mediums of Korean cultural exports such as video games, cuisine, and cinema, Gen Z proved an enthusiastic fanbase for K-Pop icons.

K-Pop’s growth in Latin America is an interesting phenomenon, because on the surface level, geographic proximity, linguistic variation, and cultural differences could lead some to write off the region as fertile ground for the genre. Yet K-Pop has made great strides in bridging the cultural divide. For instance, many K-Pop artists have released Spanish tracks and collaborated with local artists. Additionally, the image and subject matter of K-Pop seems to have struck a chord with Latin audiences. Optimism, modesty, love, self-improvement, hard work, and restraint are all wholesome departure from Western Pop music, meaning K-Pop represents a "new and cheerful start" to the youth of South America.

There are also historical and economic ties with the region. Koreans began immigrating to the region as early as 1905, and by the middle of the century, several waves of immigrants had settled in Mexico, Brazil, and Argentina. Business opportunities soon followed. For instance, LG has had business partnerships in Panama since 1962, when it became an export hub for televisions. Similarly, Samsung established an assembly plant in the 1980s in Tijuana to manufacture a variety of appliances. As with Asia, these Korean companies are using K-Pop as brand ambassadors in Latin America while simultaneously supporting Korean cultural centers and K-Pop contests.

Top North and South American Cities for K-Pop

When looking at the top cities represented in the North American region we see that U.S. metropolis’ such as Los Angeles and New York consistently make the list. This is to be expected given the size, diversity, and cosmopolitanism of these two cities. We also see smaller US cities such as Denver and Fort Collins make the cut, indicating that the K-Pop phenomena has not been relegated to the coasts. Canada, despite having a similar demographic makeup to the United States, is only represented by Toronto as the 10th biggest city in terms of Instagram Followers.

Mexico is also a large consumer of K-Pop, landing in the Top 2 cities in terms of Spotify Monthly Listeners and YouTube viewership, although it appears further down the list (No. 7) when looking at Instagram Followers. Mexico City’s large multicultural population of 22 million has led it to become Spotify’s largest streaming market, resulting in the adopted moniker “the streaming mecca of the world.” As such, it also plays a significant role as a Trigger City.

Looking at South America, we see that major capitals such as Santiago and Lima consistently land in the Top 10 for K-Pop fandom. Similarly, large metropolitan Brazilian cities such as São Paulo and Rio de Janeiro are also represented. These cities possess a young, enthusiastic, and wired audience, making them ideal target markets for K-Pop's preferred demographics.

Historical Change Across Cities

When digging into historical trends for some of these top cities, we see that while all cities trended negatively on YouTube, most cities climbed across Instagram and Spotify. Though more pronounced, this echoes trends seen across Asian cities, a sign that video consumption of K-Pop could be softening. Out of the cities mentioned above, Mexico performed the strongest, showing an absolute growth in both Instagram (817 percent) and Spotify (68 percent) metrics since March. This is unsurprising given its large multi-cultural population. Conversely, as a smaller city, Lima performed the softest, declining on Instagram (-75 percent) and Spotify (-22 percent) over this 5-month period. Los Angeles, São Paulo, and Santiago saw mild growth over this period, likely due to K-Pop's saturation in these markets.

Conclusion

In summation, we see that K-Pop has evolved to be a widespread genre not only regionally, but across the globe as well. While geographic proximity has the strongest correlation with the fandom of K-Pop, over the last 10 years, the genre has managed to overcome this boundary and has established a burgeoning audience in both North and South America. In part, this is due to South Korea’s position as an economy driven by exports. Korean companies in industries ranging from electronics to gaming have established the model for turning localized success into household names across the globe: a model that K-Pop is now building upon.

K-Pop itself has been crafted with the goal of accessibility in mind. Catchy Pop tunes incorporating bouncy beats, dance numbers, and positive lyrics sung by young idols has resulted in an approachable musical style that has successfully bridged cultures. In addition, K-Pop's openness to incorporating local culture has transformed it from a Korean art form to a truly globalized cultural powerhouse, one that has managed to attract both foreign direct investment and soft power for the homeland.

As the interest in K-Pop continues to grow, it remains to be seen whether the global interest shown toward this genre is a fleeting trend or a more sustained movement. Few predicted the global appeal of K-Pop and its rise in the West, and it will be equally difficult to determine if K-Pop can deepen its roots as a musical style. That said, K-Pop has shown itself to be a catchy and resilient art form, solidifying its position as a genre that's increasingly popular worldwide.