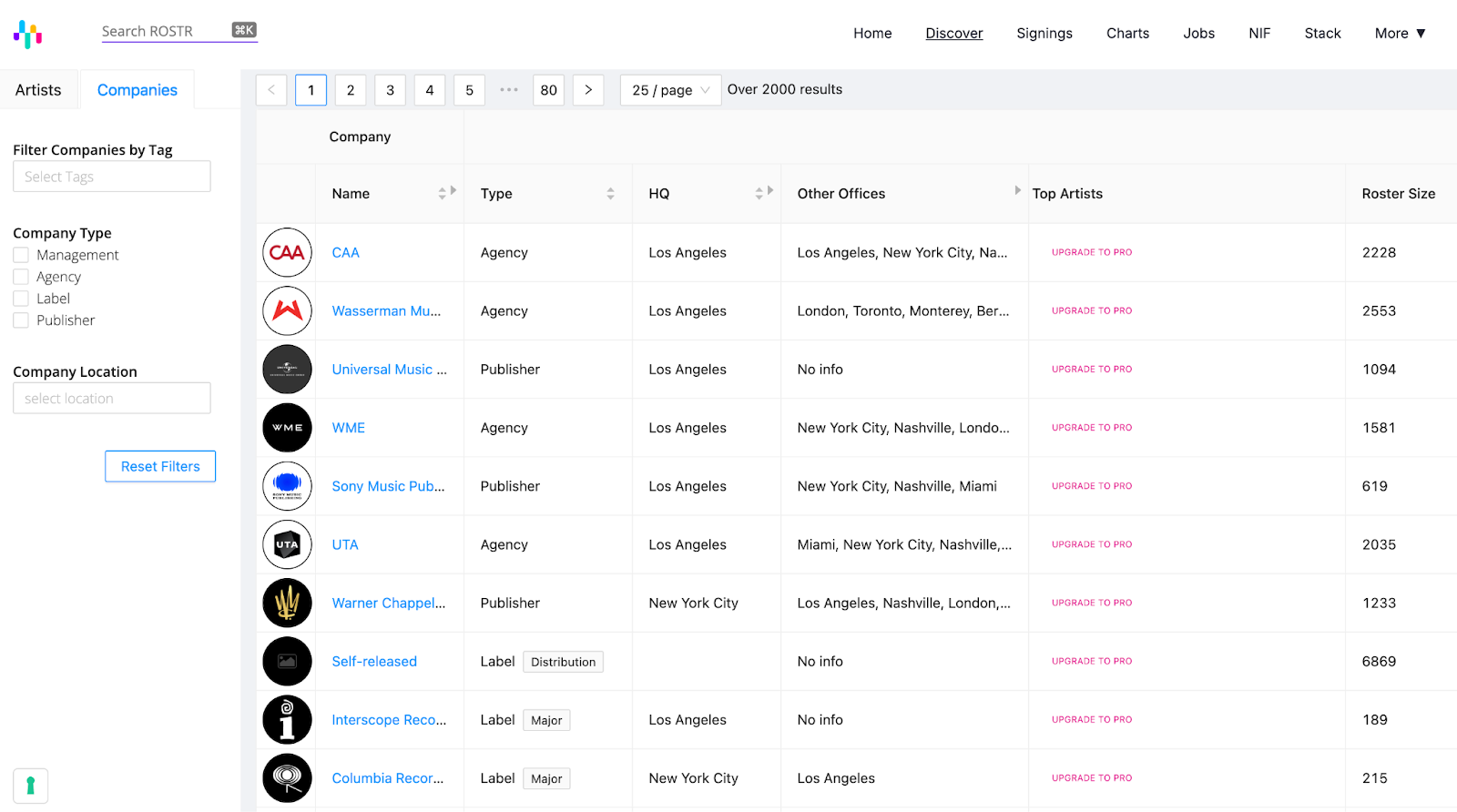

Mark Williamson is the CEO and Co-Founder of The ROSTR group, which has grown into a multifaceted music industry platform. The flagship product is ROSTR, a comprehensive music industry directory for management, agency, label, and publisher information.

After Williamson spent several years at Spotify building the Artist Services team, he often had trouble finding contact information, which only expanded as the streaming era has seen millions more artists come on the market.

“The industry has shifted from a time when knowing a dozen people in New York and LA meant you could reach almost anyone, to a world where it’s impossible to know everyone - let alone keep up with the new players and emerging scenes across Latin America, Africa, Asia, and everywhere in between,” Williamson says.

After years of pulling teeth and combating “that’s the way it’s always been done” thinking, ROSTR has become a universal hub for data in addition to growing its portfolio of products:

The second product ROSTR launched was Jobs by ROSTR, a music industry job board. Then they opened Stack, which brings professionals to catalogs services and resources across the music industry. Users can go to Stack to find books, podcasts, publicists, marketing agencies, and over 3,500 different listings of music industry resources. Recently, ROSTR has also expanded into editorial via the newsletter New Industry Friday and the news platform New Industry Focus.

Read on to learn ROSTR’s mission for their fleet of products, how their aggregation strategy has shifted over the years, and trends they’ve seen within their own data.

What is your goal for uniting all the elements of ROSTR behind a singular brand?

At the core, all of our products exist to make it easier for professionals in the music industry to do their jobs. We are very deliberately focused on professionals rather than trying to build a platform for tens of millions of artists. It's stuff that loads of people think is boring. You're never gonna have somebody who says their dream is to build B2B directory software for the music industry. But if we help managers, labels, agents, marketers and everyone around the artist do better work, the artists benefit from that.

The thing that ties everything together is data. The industry has historically not shared much data, which makes it harder to collaborate and even to do basic work efficiently. Every ROSTR product is really a different way of encouraging the industry to share accurate information with us and with each other, so everyone can work together more effectively.

Uniting everything under ROSTR means that all of these products can benefit from each other and create more incentives to share data. Someone might come in to share their label roster but then also post their first job. Someone else might read a news article and then tell us about a signing.

All of this about creating a more modern, transparent industry that benefits everyone - not just the incumbents. One of the best pieces of feedback we ever got was from a young manager who told me “when I started out I worked with this great artist but I didn’t know anyone in the industry. ROSTR helped me make a bunch of connections I wouldn’t have had access to otherwise.”

How do you source all this data and signings as they happen?

The original idea was to build a self-serve, LinkedIn-style network where everyone in the industry would just come in and update their own profiles. It became pretty clear that getting that level of buy-in from a cold start was going to be almost impossible, so we took a different route. We started by doing the hard work ourselves - adding the first 15,000 or so artists and their teams using whatever we could find online plus our own networks. We found a bunch of information on Facebook About pages. Anyone remember those? By the time we launched, it was already arguably the biggest database of its kind.

The hope was that if we put something genuinely useful into the world, people would start sending us data. It took time, but that is now what’s happening. In the early days, 100% of our data was research based. Today, roughly 25% is research and about 75% comes directly from stakeholders: labels, management companies, agencies and artists. The more data we get, the more valuable the platform becomes, which in turn gives people more reason to keep our data accurate and complete.

One of my favorite moments was an agency partner who told me, “Over my dead body, you’re never getting our data,” and they are now one of our biggest customers. And everyone benefits from this greater transparency.

How did you flip things around in that regard?

Being a genuinely valuable resource is fundamental. But we learned that is not enough on its own. This is an industry that has done things a certain way for decades and you really need to incentivize people to change their habits.

A big unlock for us was the first Coachella infographic we put out in 2020. It took the data off the platform and put it in front of people in a way that was visual and shareable. It reframed the database from being a pure utility into something that could tell stories about the industry.

Since then we have invested heavily in this kind of data and in publishing a huge amount of content every week. That does two things at once: a) it markets the platform, which brings in more users which makes it more valuable to ensure your data is listed. b) it incentivises companies and teams to share data because they want to be featured in what we publish to what is now a large, targeted audience. It helps drive a flywheel which ultimately ends in more transparency and better collaboration across the industry.

Crucially, none of this is pay-for-play and it won’t ever be.

As you’ve accrued more data on ROSTR, have you noticed any interesting trends?

Back in 2019, just after we launched, we did a report on the artist management ecosystem. At the time, the largest roster was Red Light with over 350 artists. After that, there were half a dozen companies with 50-70 artists and then the scale dropped off quickly. If you look on ROSTR today, Red Light has over 500 artists and there’s now 4-5 companies with 100+ artists and many more with 50+ artists.

So we are seeing a couple of things. First, there are simply more artists, and more of them are making meaningful amounts of money. Second, companies now have access to financing that lets them build much larger rosters. Within that, the rosters seem to be more sustainable than they used to be, because a bigger share of those artists are doing solid business rather than just one or two carrying the whole company.

We are also seeing the emergence of a kind of quasi-major tier of management companies. They are still nowhere near the scale or concentration of the major labels or major agencies, but there are now a few mega management companies that a lot of the world’s biggest artists are consistently upstreaming into - companies like Red Light, Full Stop, Good World, SalxCo, Roc Nation, Range, Three Six Zero. In our last management report, which was a couple of years ago now, these companies were way out in front of the rest of the field. You can see the beginnings of true management powerhouses in a way we have not really seen before.

At the same time, there is a counter-trend in the form of the “power boutique” - companies that are very intentionally staying at 10–15 artists, but almost all of them are superstars. Firms like Crush, Tap and Habibi are not going for mass scale, but a very high percentage of their rosters are generating serious revenue each year.